How can I manage my college finances?

As a college student, managing your finances can be challenging. Between tuition, textbooks, rent, and other expenses, it's easy to feel overwhelmed. However, with some careful planning and budgeting, you can take control of your finances and set yourself up for success. Here are a few tips to help you manage your college finances:

Create a budget

Creating a budget is the first step to managing your college finances. Start by listing all of your sources of income, including any financial aid, scholarships, or part-time job earnings. Then, make a list of all your expenses, such as tuition, rent, food, transportation, and entertainment. Once you have a clear picture of your income and expenses, you can allocate your money accordingly and avoid overspending.

Save on textbooks

Textbooks can be a significant expense for college students, but there are ways to save money. Consider buying used textbooks, renting them, or even borrowing them from the library. You can also look for digital versions of textbooks, which are often cheaper than physical copies. By being resourceful, you can save hundreds of dollars on textbooks each semester.

Take advantage of student discounts

Many businesses offer discounts to college students, so be sure to take advantage of these opportunities. Whether it's discounted movie tickets, meals, or public transportation, these savings can add up over time and help stretch your budget further.

Limit eating out and takeout

It's easy to overindulge in eating out and takeout, but these expenses can quickly add up. Consider meal planning and cooking at home to save money. Not only is it cheaper, but it's also healthier in the long run. If you do want to eat out, look for student discounts or special promotions to save a few bucks.

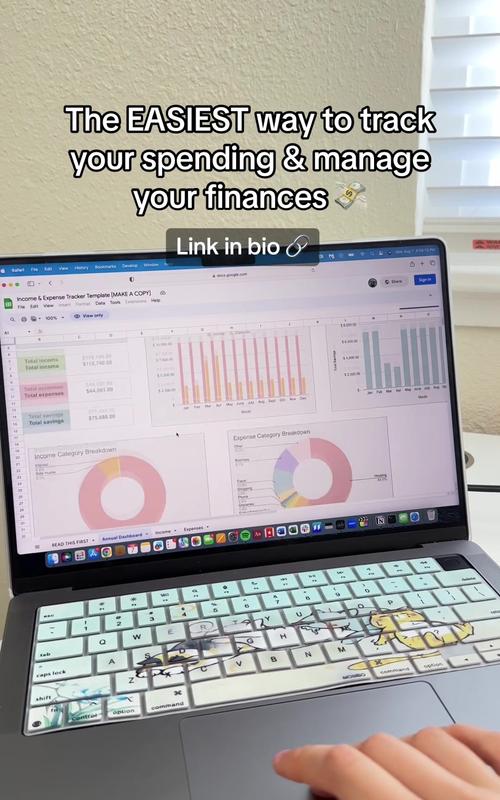

Track your spending

Keeping track of your expenses is crucial for managing your finances. Use a budgeting app or simply create a spreadsheet to monitor where your money is going. By doing so, you can identify any unnecessary expenses and make adjustments to your budget as needed.

Take advantage of campus resources

Many college campuses offer resources to help students manage their finances. This may include financial literacy workshops, counseling services, or access to free or low-cost amenities. Take advantage of these resources to gain a better understanding of your financial situation and learn how to manage your money more effectively.

Conclusion

Managing your college finances may seem daunting, but with careful planning and budgeting, it is entirely possible. By creating a budget, saving on expenses, taking advantage of student discounts, and tracking your spending, you can gain control over your finances and set yourself up for financial success during your college years and beyond.